By contributing author Charlie Willmott, Principal, WillGo Transportation Consulting, LLC

What trucker enjoys turning down customer loads in peak season when demand and rates are at their highest?

If you raised your hand to answer this question in the affirmative, thanks for stopping by…no need to read any further. You are hereby released on your own recognizance.

For the rest of you, read on. Even if you have been doing it for 100 years (like me), it doesn’t hurt to review the blocking and tackling fundamentals you need to play the game well.

And here are those fundamentals:

|

Planning for the Peak – Basic Blocking and Tackling… 1. Watch Your Trailer to Load Ratio Daily and Compare with Previous Periods 2. Know Your Shipping Customers and Their Freight Load Cycles 3. Follow Recent Industry Trends That May Impact Seasonality 4. Keep Your Fleet in Tip Top Shape…Ready to Go and Where it Needs to Be 5. “Just In Time” - Adjust Your Trailer Own/Lease Balance Quarterly/Annually 6. “Just In Case” – Commit in Advance to a Peak Season Rental Buffer in Key Locations |

So now what? If you are interested in learning more about each fundamental, great, read on!

As simple as this list of six steps may sound, actually getting them right in practice is much more difficult. Even with all available historical and current trend data at your fingertips, your ability to forecast peak season needs for trailers comes down to, at best, an educated guess. The margin of error in your planning and preparation is ultimately dependent on factors largely outside your control including:

- World politics & geo-political conflicts

- Natural disasters and catastrophes

- Economic and industry influences (eg, inflation, regulatory mandates, etc.)

- Technology disruptors, and

- Poor guidance and advice from trusted sources

Let’s begin with a review of when “peak season” happens.

First, there are as many “peak seasons” as there are shippers. Produce and flower shippers peak at various times during the year. Candy and greeting card shippers peak at other times. Paint and building materials peak at yet other times. You get the picture.

Unique product shipping seasons aside, the historic general freight market shows some clear annual patterns including minor peaks at the end of the first and second fiscal quarters and a dominant winter holiday surge usually beginning between late June and early September, peaking in late November and more recently resurging in January to accommodate gift returns, exchanges, and post-holiday sales.

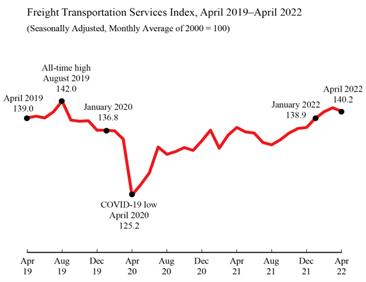

The following chart from the US Bureau of Transportation Statistics (US BTS) shows these trends from 2019 to 2022. Obvious during this time period is the atypical effect of COVID in April 2020 and the subsequent recovery, but despite the steady incline in post-COVID freight, quarterly and annual seasonality still shine through.

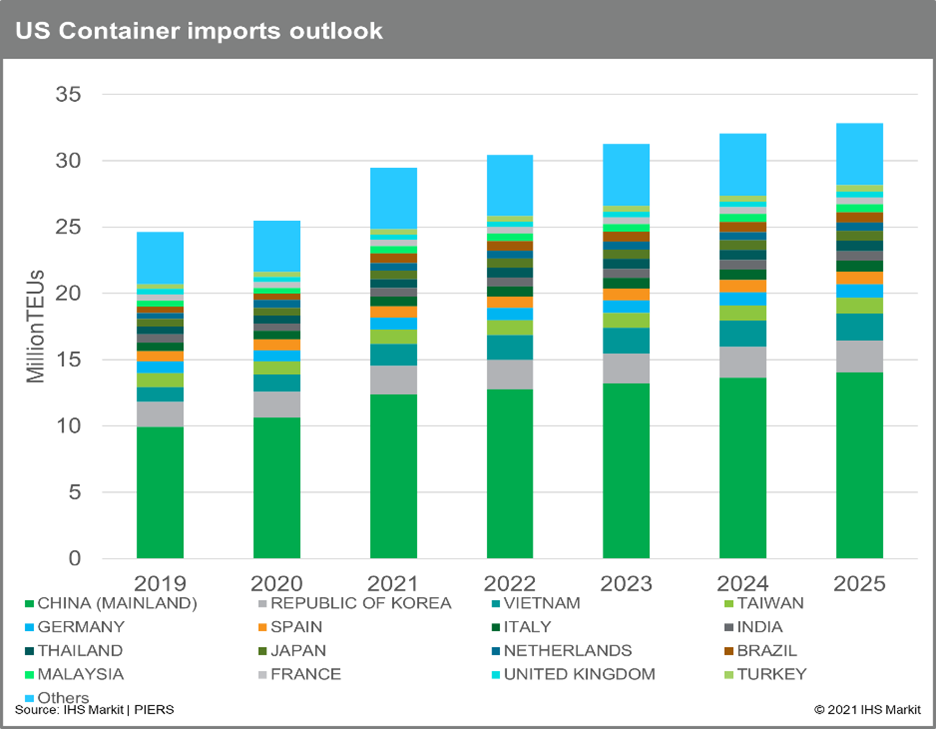

It is also clear that globalization of the US economy over the last 40 years has proven that marine container imports are a lead forecaster for the strength of US domestic freight patterns. In that regard, the recent history and outlook for containerized US imports has never been stronger. The following chart from the Journal of Commerce Piers Analytical Database (IHS Markit) illustrates this.

With that background on the macro-economic trends effecting all shippers and carriers, let’s review the inputs that are more under your control to gather, analyze and help formulate your peak season strategy:

- Watch Your Trailer to Load Ratio Daily. Clearly this fundamental can be expanded to read “watch all your trailer fleet data.”. This might include maintenance downtime, customer dwell time and detention, geographic distribution, etc. The point is that internal trailer fleet data is your most critical peak planning resource. By watching it closely and comparing it to previous calendar periods you can create a baseline forecast for the volumes you are able to cover with existing assets as peak demand unfolds.

- Know Your Shipping Customers. The earlier in the year that you understand your customers’ forecast for peak season loads, the easier it is to prepare to meet their expectations. Not only is it generally recommended to stay in close contact with your shippers to maintain a “top of mind” level of sales and customer service, but customer feedback is also your second most important peak load forecasting information source. An intimate understanding of your shippers’ current needs and peak load projections provides indispensable data to plan for your own peak trailer needs.

- Follow Seasonal Industry Trends. There are many forecasting resources available to the trucking industry. Just reading industry trade journals on a regular basis is a good basic practice for staying in touch with economic and operational trends shaping seasonal load cycles. In addition, there are both free and subscription services accessible on-line that routinely predict future industry results. The text box at the end of this article provides you with a selection of sources that can help you shape your own forecasts.

- Keep Your Fleet Ready-To-Go. Fleet readiness is vital to all truckers including: deferred maintenance is more expensive than routine maintenance, deferred maintenance is a safety risk to everyone, poor maintenance increases cargo loss rates and reduces customer satisfaction, etc. In reference to preparing for peak season, having your trailer fleet 100% available allows you to capture important loads that you need to move now. Success in making well-maintained trailers available creates a positive customer response that results in more additional load revenue. Trailers sitting in the back of the yard awaiting repair cost you dearly.

- Review Your Balance of Owned vs. Leased Trailers. Opinions on the balance you need between owned and leased trailers. The more specialized your operation and unique your trailer needs are, the more likely you may want to own 90 – 100% of your trailer fleet. The more general your cargoes and common your trailer specs, the higher percentage of leased or rented equipment you may choose to use to help with seasonal and cyclical peaks. Of course, there are many other reasons to consider leasing or renting including financial strategies, maintenance support, one-way traffic lanes, customer pooling requirements, etc., but the focus of this article is managing and maximizing your peak season needs. Cyclical and seasonal leasing or renting to supplement your available trailer fleet is the best and most common strategy used by the industry to meet peak needs, but you must make your commitments early or risk being shut out,especially given the currently historic trailer demand levels of the last several years. If you are only “just in time,” you may be just too late.

- Commit Early. There is a delicate balance between renting enough trailers to manage your peak season and either renting too many or too few. However, as we have seen clearly with the post-Covid supply chain issues, it is safer to practice more “just in case” than “just in time” with your available trailer supply. Work closely with your trailer leasing partners to better understand when you need to make your rental commitment, how many, and where. Current trailer availability (purchase, lease or rent) is the tightest of the last 40 years. Even early commitments may be hard to confirm in today’s environment, but working closely with your Premier Trailer Leasing professional sales rep is your best bet to maximize your peak season opportunities.

After doing all this and concluding that you will need to supplement your trailer fleet at some point with lease/rental equipment, you should then consider the rental or lease plans that will work best for your operation. Here are some common options to consider:

- Rent versus Lease – Typically, trailer rentals have contract terms of fewer than 365 days and are billed monthly in arrears. Leases have contract terms of one year or longer and are billable monthly in advance.

- With or Without Maintenance – Traditional “net” leases or rentals include the trailer, licensing and registration. Other costs that are typically the responsibility of the customer (eg, the “Lessee”) include maintenance and repair, road service, pick-up and delivery, insurances, annual inspections, trailer tracking, and empty repositioning. Upon request, some of these additional services can be packaged by your leasing company provider (eg, Lessor) and/or selected as options at additional cost.

Be sure to ask your trailer lease/rental sales representative for a full run-down on the services and options they can provide.

If you are new to trailer fleet management or have never previously had the need to rent or lease supplemental trailers, who should you call? There are literally dozens of possible trailer rental/lease providers depending on your location and need. Each of these companies has a unique focus with regard to the type of equipment and services they offer. Some specialize in later model “over-the-road” quality equipment, others provide only cartage and storage suitable trailers. Some provide a mix of vans, reefers, flatbeds, container chassis, and other specialty trailers…some a narrower selection.

With over 60,000 trailers and more than 40 locations, Premier Trailer Leasing is one of the largest trailer rental/leasing companies in the US with an incomparable selection of trailer types and services including real time GPS trailer tracking, remote reefer monitoring and control, CARB compliant/fuel saving features, free access to 24-hour emergency roadside assistance, and a full state-of-the-art web portal.

Finally, the following table lists a selection of industry data resources that may be helpful to your individual peak trailer fleet planning process.

|

Key Trucking Industry Data Resources ACT Research– https://www.actresearch.net/ ATRI (American Transportation Research Institute) - https://truckingresearch.org/ Cass Freight – https://www.cassinfo.com/about-us DAT Freight & Analytics – https://www.dat.com/ IHS Markit, Piers International - https://ihsmarkit.com/products/piers.html FTR Transportation Analysis – https://www.actresearch.net/ Jason Miller, Supply Chain Professor Michigan State University – FREE Regular Postings https://www.linkedin.com/in/jason-miller-32110325/ US Bureau or Transportation Statistics – https://www.bts.gov/

|